- HAMBORNER REIT AG

-

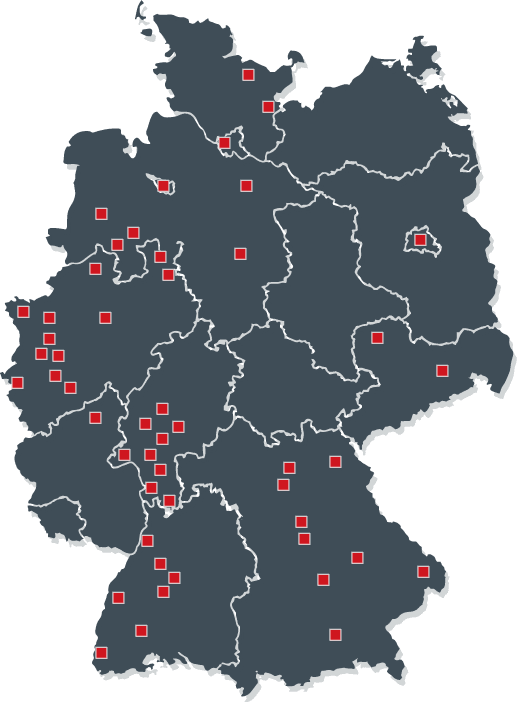

- PORTFOLIO

-

- INVESTOR RELATIONS

-

- AKTUELLES

- NACHHALTIGKEIT

-

Nachhaltigkeit

Nachhaltigkeitsstrategie

NachhaltigkeitsstrategieErfahren Sie mehr über unsere Strategie und unsere Aktivitäten im Bereich Nachhaltigkeit

-

- KARRIERE

-

Karriere

HAMBORNER als Arbeitgeber

HAMBORNER als ArbeitgeberLernen Sie HAMBORNER als Arbeitgeber kennen und erhalten Sie Einblicke in unser Team und unseren Arbeitsalltag

-